Crypto Adoption: What’s Taking So Long?

October 2025 has been brutal for crypto holders. With markets underperforming, mass liquidation events, and a generally bearish (and fearful) sentiment among holders.

Perhaps even more disorientating is the fact that this is happening while the lansdcapse has its first crypto-friendly administration in the US.

So what’s the deal? What will it take for true “crypto adoption” to take storm?

Are We Still “Early”?

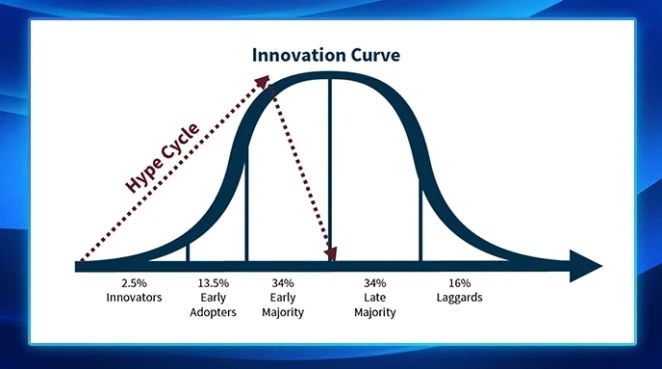

Crypto enthusiasts love saying that blockchain is still in the early adoption phase.

For the most part, that appears to be true.

According to Glassnode, there are still fewer than one million active Bitcoin addresses — a drop in the ocean compared to the overall number of users on the internet.

So it stands to reason that there’s still plenty of room for growth.

The real question is: will adoption come from above or from the bottom up?

The truth? It’ll depend on these 5 key triggers boosting crypto adoption across the globe.

5 Triggers For Crypto Mass Adoption

Crypto faces substantial obstacles that prevent its widespread adoption.

New crypto startups regularly emerge to solve product-related problems — some offer high scalability and low fees, while others focus on user-friendly tools.

With the Trump administration’s positive turn towards crypto, large TradFi companies are increasingly implementing blockchain into their workflows.

But we’re still far away from crypto being a dominant force in an average person’s day-to-day life.

For that to change, these 5 triggers would have to be addressed?

1. REGULATORY GREEN LIGHT

The lack of regulatory clarity has long been one of the key factors holding back the success of crypto.

Luckily, things seem to be changing at last. Some of the key global initiatives creating a favorable environment include:

- New laws in the U.S: In 2025, the Trump administration implemented a set of crypto-friendly initiatives, such as the GENIUS Act, the CLARITY Act, the Strategic Bitcoin Reserve, and several executive orders establishing clear guidelines for crypto-related activities.

- MiCA regulations in the EU: Adopted in 2023, the Markets in Crypto-Assets (MiCA) regulation defines the framework for blockchain companies and their customers. The taxes it implies are rather high, though. For example, in Portugal, one must pay a 28% capital gains tax on assets held for less than a year, while in Germany, income tax may reach 45%.

- Legal frameworks in other regions: Japan’s FSA, the UAE’s VARA, Singapore’s MAS, and other local regulators are acknowledging crypto and introducing clear frameworks for its use.

2. INSTITUTIONAL-GRADE INFRASTRUCTURE FOR TRADFI

TradFi controls the majority of global capital. Once large players like banks and payment providers plug into crypto rails, adoption will scale instantly.

- Crypto ETFs: Fidelity, Grayscale, Valkyrie, and other major issuers are already attracting billions in inflows.

- Stablecoin payments: Visa and MasterCard are testing Ethereum- and Solana-based solutions to speed up cross-border transfers.

- Swift & Consensys: The global payment provider aims to create a blockchain-based transactional infrastructure enabling instant cross-border payments.

3. BIG TECH INTEGRATION

Tech giants like Google and Amazon may embed blockchain tools and features such as wallets and identity solutions into their ecosystems.

Once they do, hundreds of millions of users will be onboarded instantly — often without even realizing they are using crypto.

- Google & Coinbase: Google Cloud has partnered with Coinbase to integrate crypto payments, blockchain data access, and institutional custody, bridging traditional cloud infrastructure with Web3.

- Apple Pay & Mesh: A global crypto payment network Mesh has integrated its solution with Apple Pay, allowing merchants to accept crypto payments settled in stablecoins of their choice.

- PayPal’s PYUSD: The global payment network continues to expand its native stablecoin across multiple blockchains, offering users high-throughput, low-cost daily payments.

4. CENTRAL BANK DIGITAL CURRENCIES (CBDCS)

Issued by central banks, CBDCs are blockchain-based or blockchain-inspired versions of national currencies. Such initiatives make digital money official, encouraging billions of people to use it.

China’s CBDC is a prime example. Although the digital yuan is still in its pilot stage, its official app recorded 180 million wallets with transactions totaling ¥7.3 trillion in July 2024.

5. GOVERNMENT-LED BLOCKCHAIN ADOPTION

Government implementation of blockchain for registries, IDs, governance, and other areas can boost both usage and public trust.

Moreover, blockchain-based infrastructure developed by authorities can later be reused by the private sector, driving adoption even further.

Notable initiatives include:

- Tokenization of financial assets in India: In October 2025, the Reserve Bank of India (RBI) announced a pilot program for tokenized certificates of deposit, creating digital versions of physical financial assets with faster transactions, lower costs, and stronger security.

- Establishment of the Pakistan Crypto Council (PCC): Launched in March 2025, the Council is tasked to integrate blockchain into the local financial system and to develop regulatory frameworks for crypto usage and taxation.

- California DMV blockchain integration: In July 2024, the Department of Motor Vehicles in California digitized 42 million car titles on blockchain to combat fraud and simplify the title transfer process.

The Truth About "Full" Crypto Adoption

Full crypto adoption is a myth — and true widespread adoption won’t happen overnight.

But gradual crypto adoption is taking place right now. Without most people even noticing.

This week alone, major crypto players like Coinbase, Circle, and Chainlink were invited to join US regulators at the Fed’s Embracing New Technologies and Players in Payments conference.

Meanwhile, US President Donald Trump continues to openly praise crypto, popular coins like BTC broke new all-time highs this year, and regulators are actively trying to make friends — not foes —with crypto businesses and end-users.

This means that, whether it’s reflected in the market or not, crypto is becoming a part of our lives through quiet integration.

Join The Leading Crypto Channel

JOINDisclaimer:Please note that nothing on this website constitutes financial advice. Whilst every effort has been made to ensure that the information provided on this website is accurate, individuals must not rely on this information to make a financial or investment decision. Before making any decision, we strongly recommend you consult a qualified professional who should take into account your specific investment objectives, financial situation and individual needs.

Kate

Kate is a blockchain specialist, enthusiast, and adopter, who loves writing about complex technologies and explaining them in simple words. Kate features regularly for Liquid Loans, plus Cointelegraph, Nomics, Cryptopay, ByBit and more.

Development

Knowledge

Subscribe To Newsletter

Stay up-to-date with all the latest news about

Liquid Loans, Fetch Oracle and more.

Copyright © 2024 Crave Management.

All Rights Reserved.

The LL Librarian

Your Genius Liquid Loans Knowledge Assistant