Crypto Prediction Markets EXPLAINED

Prediction markets have become a multi-billion-dollar industry in crypto, almost overnight. Right now, crypto prediction markets account for over $23 billion USD in value, often hitting close to $100 million USD in daily transactions.

Major platforms like Polymarket have even broken outside of the crypto sphere, being parodied on a recent episode of South Park and used by sports fans who may never otherwise have interacted with crypto at all.

On the basis of their underlying blockchain technology, these new markets represent powerful tools that allow users to trade predictions in a fully transparent and decentralized manner.

Here's everything you need to know to make sense of this new billion-dollar playground.

Prediction Markets Made Simple

Simply put, prediction markets are platforms that let users bet on the outcomes of events.

This goes beyond the kind of gambling and betting markets you'd expect, because it's not just sports and politics that people are putting their money behind.

Rather, crypto prediction markets let you bet on virtually anything as long as there's a verifiable outcome.

This means you could, for instance, use a platform like Polymarket or Augur to bet on the weather, future Nobel Peace Prize winners, pop culture events, and even things as trivial as whether or not Federal Chair Jerome Powell will say "good afternoon" in his next address.

The concept is simple: if your forecast is correct, you win money; if not, you lose your stake.

In some ways, this goes beyond just betting. Because it's actually sourcing wisdom from people who are willing to put their money behind their predictions.

As a result, the wisdom of the crowd can, in theory at least, lead to more accurate predictions than those provided by traditional analytical methods.

How Do Prediction Markets Work?

Prediction markets provide a venue for interaction between buyers and sellers who speculate on the outcomes of future events.

As each market covers a specific event, users can purchase shares corresponding to the outcome they believe will turn out to be true. The price of each share typically ranges between $0 and $1, reflecting the market’s collective opinion about the probability of the event.

The prices may change over time, along with the crowd’s sentiment. If the price of a particular share rises, one may sell it before the event and lock in their profits.

After the event takes place, the winning party receives a $1 payout per share, while the losing shares become worthless.

This isn't that different to the kind of gambling you might be used to on a sports betting website. The only difference you really need to be aware of is that, on a decentralized crypto prediction market, your bets are settled automatically by smart contracts.

The History of Prediction Markets

While they're a massive new avenue in crypto, prediction markets themselves have actually existed in various forms since the 16th century.

At that time, papal succession and royal marriages were some of the most popular events people speculated on, earning money if their guesses turned out to be correct.

In the late 1800s, Wall Street in the US popularized election betting, as newspapers regularly quoted odds. In some years, prediction activities even exceeded stock trading in volume.

In the 20th century, election betting as a public forecasting tool was gradually replaced by opinion polls conducted by companies like Gallup.

In 1988, the Iowa Political Stock Market (later renamed the Iowa Electronic Markets) formalized trading tied to event outcomes. This platform can be considered the first modern, research-oriented prediction market. In particular, it correctly predicted the US presidential election won by George H.W. Bush.

The new century brought a plethora of online platforms, with blockchain-based solutions offering advantages such as transparency and censorship resistance.

Types of Prediction Markets

Prediction markets can be categorized into several types, each tailored to different kinds of questions and answers:

- Binary markets offer only two outcomes (e.g. Yes/No, Will happen/Will not happen). The shares pay $1 in case of a correct prediction and $0 otherwise.

- Categorical markets operate with events that have more than two mutually exclusive outcomes (e.g., “Which of the four candidates will win the election?”). Each option share pays $1 if correct.

- Scalar markets focus on numerical results within a predefined range (e.g. “What will the inflation rate be at the end of the year?”). Traders get paid proportionally to how close the reported outcome was to their prediction.

- Combined markets enable more complex but powerful strategies based on “if-then” scenarios (e.g. “If candidate X wins, what will be the S&P 500 index?”).

Regardless of the market type, participants can sell their shares at any time, as there is no lockup period.

Thus, crypto prediction markets offer a more flexible way of earning (or, let's face it, gambling) than some other DeFi tools.

Top 3 Blockchain Prediction Markets

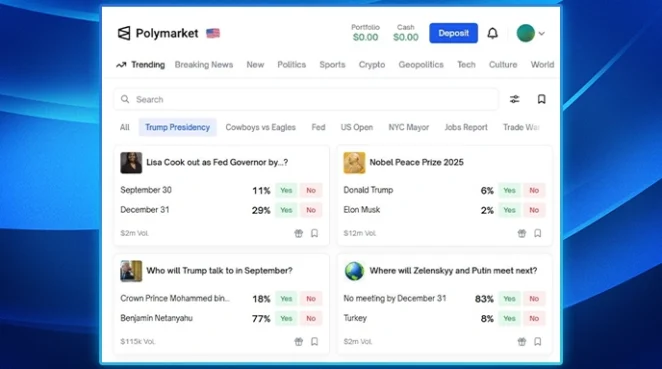

1. Polymarket

Link: polymarket.com

Blockchain: Polygon (Ethereum sidechain)

Polymarket is one of the largest decentralized prediction markets. It allows betting on a wide variety of events, ranging from cryptocurrency prices to political outcomes and the performance of tech companies.

On this platform, users may buy or sell shares in the outcomes of events, with each share resolving to $1 or $0. To ensure accurate outcomes, Polymarket relies on multiple tools such as oracles, decentralized reporting, media verification, and dispute mechanisms.

2. Augur

Link: www.augur.net

Blockchain: Ethereum

Launched in 2018, Augur is a decentralized prediction market platform that allows users to create and trade shares representing the outcomes of various events.

Augur is fueled by its native token, REP (Reputation), which incentivizes accurate outcome reporting. Designated reporters stake REP as collateral and submit the outcome they believe is correct.

The platform uses a consensus-based system that accepts the outcome supported by the majority of REP staked.

3. Gnosis

Link: www.gnosis.io

Blockchain: Ethereum

Founded in 2015, Gnosis is one of the earliest prediction market projects, built on the conditional tokens framework for tokenizing potential outcomes. The system programmatically ties these tokens to oracles such as Kleros and Reality.eth to ensure the correctness of input data.

Rather than functioning as a standalone prediction market, Gnosis acts as an infrastructure layer, enabling developers to create prediction applications.

How to Make a Bet on a Crypto Prediction Market

Let’s explore how decentralized prediction markets work in practice, by using Polymarket as an example.

Step 1. Set up your wallet

If you are new to crypto, you'd need to first set up a digital wallet such as MetaMask or WalletConnect and connect it to your account on the platform.

Polymarket supports a wide range of digital assets, including USDT and USDC on various networks.

You then have the option to either deposit funds from your wallet or purchase them directly within the app.

Step 2. Select a market

Platforms like Polymarket let you easily browse the markets available on the platform and click on the one you’d like to bet on.

Step 3. Buy shares and place your bet

To place a bet, you simply choose your side and place a bet on whether you think the event will happen (Yes) or won't (No) happen.

Then, you enter how much money you're willing to wager behind your prediction and finalize the purchase.

Step 4. Monitor the market and sell your shares (optional)

The price of shares may change over time, reflecting shifts in market sentiment.

This gives you the opportunity to cash out of your bet early if the value of your shares increases.

Step 5. Settlement

Once the event concludes, the platform finalizes settlement based on the actual outcome. If the result is unclear, the Market Integrity Committee steps in to reach a resolution.

If you bet on the correct outcome, you may claim your winnings and withdraw funds to your wallet.

If your prediction fails, you'll lose everything you staked. Which means it's important to apply the exact same considerations as with gambling by asking yourself how much you can afford to lose, and if your gambling is becoming habitual and problematic.

You can find helpful resources and learn more about problem gambling on the National Council on Problem Gambling's website.

Why Are Decentralized Prediction Markets So Popular?

Traditional prediction markets have proved to be powerful tools for forecasting, combining diverse opinions and turning them into tangible predictions.

Decentralized platforms, on the other hand, build on these strengths while addressing key limitations.

This gives these emerging crypto platforms competitive advantages like:

- Censorship resistance. Thanks to the decentralized nature of blockchain, no single authority can shut down specific markets, even those covering controversial or politically sensitive topics.

- Trustless settlement. Outcomes are verified through a combination of decentralized oracles and community consensus, eliminating the need for a trusted intermediary and making the system more democratic. Additionally, smart contracts ensure fair and timely payouts.

- Transparency. All transactions are recorded on a public ledger, providing auditability for any interested party.

- Global accessibility. Traditional platforms often impose geographical restrictions and require strict KYC/AML procedures. By contrast, decentralized prediction markets are available to anyone with an internet connection and a crypto wallet.

The Problem With Crypto Prediction Markets

Alas, not everything is perfect in crypto's new favorite billion-dollar-playground.

Decentralized prediction markets still have several flaws that they need to address. Some of the most critical risks include:

- Oracle problems. Oracles can only operate with the data available on the web. Therefore, prediction markets related to real-world events still rely on trusted sources when determining outcomes.

- False data. If an oracle is compromised and fed incorrect information, users risk losing their assets.

- Low liquidity. Many decentralized markets struggle with limited user participation, making it harder to buy or sell shares at a fair price.

- Market manipulation. Thin liquidity may allow wealthy actors to sway prices and perceptions by placing disproportionately large bets.

- Regulatory uncertainty. Few countries have explicit laws regulating crypto prediction markets. They may still be treated as gambling or derivatives. Platforms without proper licensing risk being banned, and users could lose access to legal withdrawal methods.

On the topic of regulatory uncertainty, it's important to note that platforms like Polymarket — while still popular in the US — was technically subject to a three-year ban.

In July 2025, the Commodity Futures Trading Commission (CFTC) and Department of Justice accused Polymarket of running an illegal exchange.

Importantly, there's also the ethical issue at hand. Crypto prediction markets make it incredibly easy to gamble large sums of money very quickly.

Since this can feel like virtual money, rather than money in your hand, this can be especially problematic. Even more so when you consider how largely unregulated these markets are in comparison to traditional gambling markets.

Resources like National Council on Problem Gambling's FAQ on Problem Gambling, as well as your own local gambling support services, are crucial for helping mitigate the damage that the rise of these platforms will likely cause vulnerable populations.

The Future of Crypto Prediction Markets

Blockchain-based prediction markets clearly offer benefits over traditional centralized betting platforms, and their popularity very likely to grow in the coming years.

As these user bases expand, even beyond what we'd think of as a "traditional crypto audience", underlying technologies must adapt. In particular, decentralized oracle networks provided by key players such as Chainlink and Band Protocol are developing solutions to make their products more scalable and cost-efficient.

A positive shift in US crypto policy could also play a role in legitimizing such activities and providing much-needed regulatory clarity.

These markets also provide valuable insight into the sentiment of the public, especially since people are forced to put their money where their mouth is by financially backing their predictions.

But we can't lose sight of the fact that crypto prediction markets are a form of gambling, subject to the same societal consequences as sports betting and casinos.

Pretending otherwise is harmful not just to the users of these platforms, but also the growth of these platforms.

Ultimately, crypto prediction markets have become one of the industry's latest playgrounds. With billions of dollars in value and millions in daily transactions, expect to hear more about these markets more often over the next few years.

Even from people who wouldn't normally talk to you about crypto.

Join The Leading Crypto Channel

JOINDisclaimer:Please note that nothing on this website constitutes financial advice. Whilst every effort has been made to ensure that the information provided on this website is accurate, individuals must not rely on this information to make a financial or investment decision. Before making any decision, we strongly recommend you consult a qualified professional who should take into account your specific investment objectives, financial situation and individual needs.

Kate

Kate is a blockchain specialist, enthusiast, and adopter, who loves writing about complex technologies and explaining them in simple words. Kate features regularly for Liquid Loans, plus Cointelegraph, Nomics, Cryptopay, ByBit and more.

Development

Knowledge

Subscribe To Newsletter

Stay up-to-date with all the latest news about

Liquid Loans, Fetch Oracle and more.

Copyright © 2024 Crave Management.

All Rights Reserved.

The LL Librarian

Your Genius Liquid Loans Knowledge Assistant