How to Spot Fake DeFi Projects

DeFi is a once-in-a-lifetime revolution, giving users one last hope at controlling their financial freedom in a world that has increasingly become about control and censorship.

But not all projects that claim to be “DeFi” are what they seem.

Behind the scenes, the crypto market is flooded with cheap imitations and malicious projects trying to trick you into thinking they’re decentralized.

So how can you tell the difference between true DeFi and cheap imitations?

In this complete guide, we’ll show you the red flags to avoid if you care about only using real decentralized projects.

With DeFi being on the rise, many projects find it tempting to name themselves decentralized while leaving control in the hands of a minority.

This article aims to discover what makes up a true DeFi project and how to distinguish it from a fake one.

What Is Centralized Finance (CeFi)?

Often referred to as CeFi, centralized finance represents the traditional financial system where entities like banks and brokerage companies control the money flow.

Acting as middlemen, these entities provide end-users with trusted solutions for exchanging value. Their key characteristics include:

- Custody over users' funds: Customers don't hold their assets but entrust them to centralized institutions.

- Censorship capabilities: These institutions have the right to freeze users' funds or fully restrict them from using their services.

- Permissioned access: Only approved individuals who have passed the KYC/AML check have the right to use the services.

- Regulatory dependence: Centralized financial companies are subject to national regulations and central authorities that can set their own restrictions on their operations.

- Counterparty risk: Institutions may commit fraud, mismanage users' funds, or simply go bankrupt.

All these features represent a double-edged sword.

On one hand, they enable CeFi to function and provide users with familiar, regulated ways to exchange value.

On the other hand, strong reliance on centralized intermediaries results in various risks and limitations. This is where DeFi comes in to save the day.

What Is Decentralized Finance (DeFi)?

In contrast to CeFi, decentralized financial tools do not require an intermediary. Users can exchange value on a peer-to-peer basis while blockchain-based smart contracts execute transactions automatically.

Key features of DeFi include:

- Self-custody of assets: Users have full control over their own funds via private keys instead of entrusting them to a third party.

- Censorship resistance: Since DeFi solutions operate on decentralized networks, no single entity can block their operations or restrict users from using their funds.

- Transparency: DeFi solutions built on public blockchains like Ethereum or Solana store all transactional records in a transparent ledger, allowing anyone to verify them.

- Immutability: Once recorded on the network, transactions cannot be rolled back or tampered with.

- Permissionless access: Anyone with a crypto wallet and internet connection can use DeFi tools without any approvals or identification procedures.

- Global availability: DeFi markets are available in any region and operate 24/7.

Thus, DeFi solutions resolve problems inherent to their centralized alternatives, offering open, trustless, and borderless financial systems. Such tools enable individuals to participate in global finance on equal terms while eliminating dependence on intermediaries and institutional control.

5 Warning Signs: Spotting Fake DeFi Projects

Implementing blockchain technology or issuing a token doesn't make a project decentralized. Creating a true DeFi tool means adhering to all key principles — decentralization, immutability, and censorship resistance — with no exceptions.

While many solutions offer DeFi-like capabilities, they remain semi-centralized due to a variety of factors. Here's what to look out for to identify a false DeFi project:

#1 - ADMIN KEYS

These are special private keys held by the project's developers that allow them to upgrade contracts or even fully shut down the protocol.If admin keys exist, a project is not fully decentralized. Whoever controls these keys may censor transactions, drain liquidity pools, pause withdrawals, and impose other types of risks on users' assets.

One may check if a project has admin keys by searching the code for the word "ownable." If it's present, the project has some bad news to share.

A true DeFi project minimizes or totally removes admin control, offering immutable smart contracts or decentralized governance instead.

#2 - PROJECT ROLLBACKS

In CeFi systems, privileged users (admins) have the power to undo transactions or roll back the chain.

In true DeFi ecosystems, no admin can ever do that. The code is law, meaning that once a transaction is recorded on-chain, it can't be undone. A DeFi project allowing rollbacks undermines the principles of immutability and decentralization.

#3 - CENSORSHIP CONTROLS

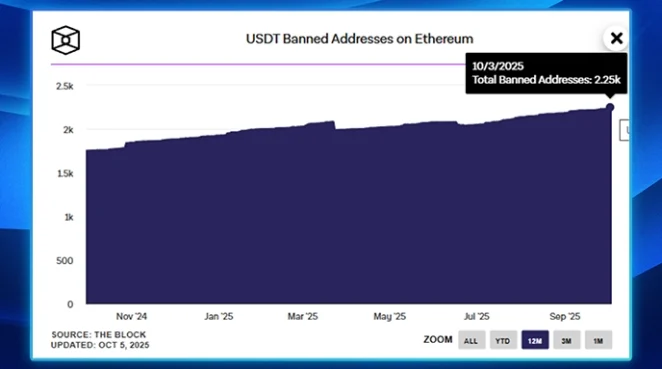

Another sign of a fake DeFi project is the capability to blacklist addresses and freeze users' funds.

Projects usually do this to prevent fraud or other illicit activities, and only after a police or court order.

However, they may also do it out of precaution, even without any decree from above. For example, a famous case of a blacklisted wallet widely discussed on Reddit involved blocking an address with around 200k USDT without any solid evidence of wrongdoing.

In true DeFi, such an event is technically impossible.

To identify if a project can do that, look out for relevant reports in major media. Tech-savvy users can also check the code of the smart contract to see if it contains functions like “blacklist()”.

#4 - CENTRALIZED GOVERNANCE AND UPGRADES

CeFi projects release upgrades to their systems unilaterally, while users have no influence on these changes.

The rules may literally change overnight, and not always for the better.

In true DeFi, upgrades require community consensus. Users control the evolution of the code by voting through a DAO.

Equally important is how the votes are distributed among token holders. A red flag to pay attention to is a small handful of insiders controlling the governance.

#5 - OPAQUE OR CLOSED-SOURCE CODE

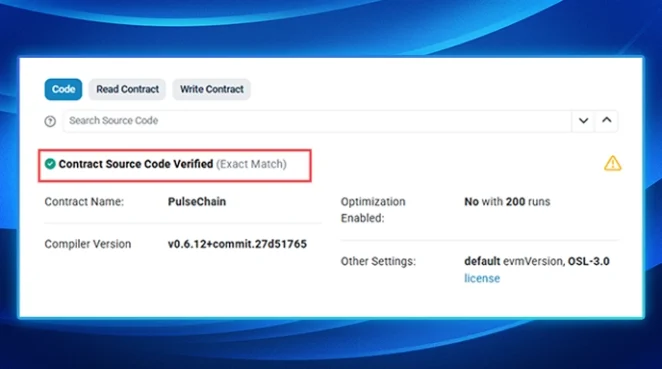

True DeFi projects develop open-source protocols with smart contracts that are verifiable on-chain.

This adheres to the principle of transparency, eliminating the need for blind trust.

Etherscan and other blockchain explorers usually contain this information, simplifying the check for non-technical users.

True DeFi vs "Semi-DeFi" Projects

While many popular blockchain projects profess the principles of DeFi, they have centralized backdoors that may lead to unpleasant results for end users.

For example, Uniswap, which claims to be a DeFi platform, can block users' addresses at the frontend level. In 2022, it blocked 253 addresses linked to illicit activities after the U.S. government imposed sanctions on Tornado Cash.

Fiat-backed stablecoins like USDT and USDC are known for freezing users' accounts and blacklisting addresses. Binance BUSD was prohibited by U.S. regulators in 2023 and delisted from all centralized exchanges altogether.

MakerDAO is governed by the community, yet its native stablecoin DAI heavily relies on centralized collateral like USDC, exposing it to potential censorship risks.

The Bottom Line

With high-profile CeFi crashes like FTX and Celsius, true decentralization has never been so important. Such incidents highlight the harm that centralized control may cause by abusing users' trust.

Fake DeFi projects that have the same level of control can be even more treacherous. While promising advantages provided by blockchain, they disguise centralization under a new label.

As the DeFi ecosystem matures, users need to learn how to identify a wolf in sheep's clothing.

Join The Leading Crypto Channel

JOINDisclaimer:Please note that nothing on this website constitutes financial advice. Whilst every effort has been made to ensure that the information provided on this website is accurate, individuals must not rely on this information to make a financial or investment decision. Before making any decision, we strongly recommend you consult a qualified professional who should take into account your specific investment objectives, financial situation and individual needs.

Kate

Kate is a blockchain specialist, enthusiast, and adopter, who loves writing about complex technologies and explaining them in simple words. Kate features regularly for Liquid Loans, plus Cointelegraph, Nomics, Cryptopay, ByBit and more.

Development

Knowledge

Subscribe To Newsletter

Stay up-to-date with all the latest news about

Liquid Loans, Fetch Oracle and more.

Copyright © 2024 Crave Management.

All Rights Reserved.

The LL Librarian

Your Genius Liquid Loans Knowledge Assistant