Is The US Is Exploiting Bitcoin to Regain Control of the Dollar?

In early 2025, the US government quietly formalized a Strategic Bitcoin Reserve. No big announcements, no buying spree. Instead, the government ushered in a sudden recognition that the roughly 200,000 BTC it already held from criminal seizures would now be treated as a sovereign asset similar to gold.

To some, it looked like symbolism. To others, a defensive move. But there may be a far more strategic play unfolding.

If you don't know how this works, you'll become a pawn rather than a player.

Bitcoin as a Global Capital Magnet

When a figure like Donald Trump reverses course and embraces Bitcoin, it sends a clear message: Bitcoin is now politically acceptable.

That signal ripples globally, especially in regions suffering from inflation, capital controls, or declining confidence in their national currencies.

And as interest in Bitcoin rises, so does global demand to acquire it.

But many of these international buyers aren’t acquiring BTC in dollars. Instead, they’re using Tether (USDT).

USDT: The Dollar’s Digital Trojan Horse

USDT is by far the most used stablecoin for crypto trading globally. With a market cap above $100 billion, it’s the go-to settlement layer for buying Bitcoin in markets like Asia, Latin America, and the Middle East.

What backs this stablecoin? Primarily short-term U.S. Treasuries.

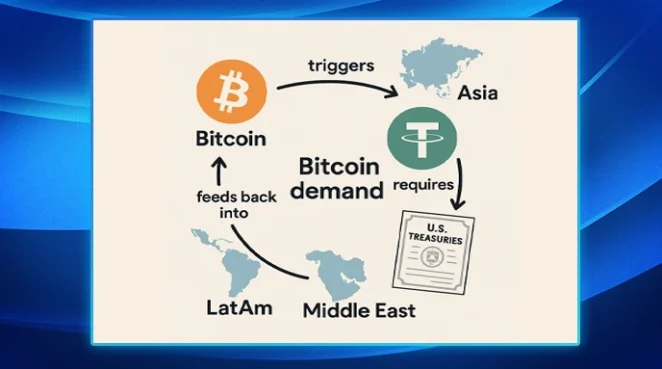

So the cycle looks like this: Bitcoin demand increases → more USDT is minted → Tether buys more U.S. Treasuries to back the supply.

The result: A non-sovereign digital asset (BTC) drives global demand for a dollar-pegged stablecoin (USDT), which in turn creates demand for U.S. government debt (USTs).

A Bitcoin Bull Market That Funds U.S. Debt?

If Bitcoin were to 10x in price—say from $110,000 to $1.1 million—the rush into BTC would be massive. Offshore capital would pour in, particularly through USDT.

Every USDT minted requires a corresponding reserve—mostly in Treasuries. So, a Bitcoin bull market could result in hundreds of billions of dollars in fresh demand for U.S. debt securities, indirectly supporting the Treasury without any explicit intervention.

At a time when central banks around the world are reducing their exposure to U.S. debt, this demand—driven by crypto markets—could play a surprisingly important role in sustaining U.S. fiscal power.

Bitcoin Freedom and Dollar Sovereignty

The big question is: is this intentional?

Maybe. Maybe not.

But the sequence is hard to ignore:

- The United States announces a Strategic Bitcoin Reserve.

- US financial giants launch regulated BTC ETFs.

- Tether continues growing, largely backed by Treasuries.

- The dollar faces pressure from BRICS, gold-backed alternatives, and CBDCs.

Right now, as you're reading this, the dollar’s dominance is being questioned. That positions Bitcoin as a strategic way to reassert it through market forces instead of military or monetary policy.

This means that even though Bitcoin was created to challenge the fiat system, its rise may now be reinforcing one of fiat’s most powerful tools: the U.S. Treasury market.

But despite the irony, it’s possible for both to win here: Bitcoin gains adoption, and the US finds a new indirect channel for dollar hegemony.

In other words we could see BTC as the freedom layer, USDT as the funnel, and US Treasuries as the beneficiary.

So whether by design or by luck, the US may have found a new way to turn financial decentralization into sovereign advantage thanks to our big orange friend: BTC.

Join The Leading Crypto Channel

JOINDisclaimer:Please note that nothing on this website constitutes financial advice. Whilst every effort has been made to ensure that the information provided on this website is accurate, individuals must not rely on this information to make a financial or investment decision. Before making any decision, we strongly recommend you consult a qualified professional who should take into account your specific investment objectives, financial situation and individual needs.

cristian

Cristian is the CEO and Co-Founder of Liquid Loans. A former partner in an international accounting firm, Cristian brings this wealth of experience to build and provide thought leadership in the blockchain and DeFi space.

Development

Knowledge

Subscribe To Newsletter

Stay up-to-date with all the latest news about

Liquid Loans, Fetch Oracle and more.

Copyright © 2024 Crave Management.

All Rights Reserved.

The LL Librarian

Your Genius Liquid Loans Knowledge Assistant