Stablecoins Are Primed For Huge Growth in 2025: Here’s What You NEED To Know

As you're reading this, major players are entering the stablecoin space, signaling a new wave of institutional interest.

With clear regulations and a growing demand for fast and cost-efficient payments, stablecoins are now closer than ever to reshaping traditional finance (TradFi) and everyday transactions.

What is fueling this surge, and who stands to benefit from it?

Let’s take a closer look.

More Stablecoin Issuers Are Joining the Race

According to DefiLlama, there are more than 20 stablecoins already on the market, with more than half of them having a market capitalization above $1 million USD.

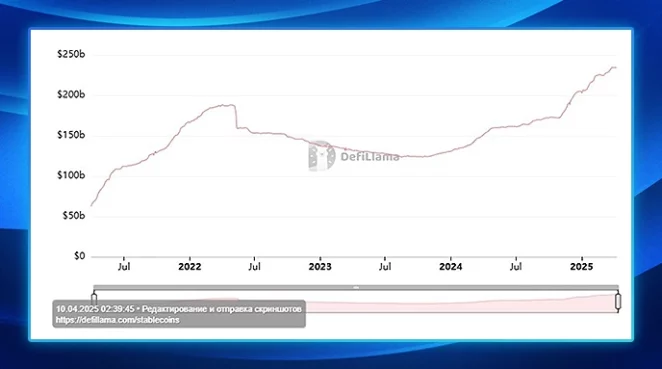

Moreover, their total capitalization has grown nearly fourfold over the past four years.

Still, more and more enterprises are entering the race with plans to issue new assets. Let’s review some recent developments:

- Fidelity is testing a dollar-pegged stablecoin, which is expected to be integrated into its tokenized US Treasury money market fund on Ethereum.

- Crypto.com plans to launch its stablecoin by Q3 2025, aiming to simplify on-platform transactions. The company also intends to file for a Cronos ETF, though few details have been disclosed.

- Donald Trump’s World Liberty Financial crypto venture will launch a dollar-pegged stablecoin called USD1 as a part of a new crypto-friendly strategy.

- PayPal, which has already released its PYUSD, plans to add it as a payment option for merchants by the end of 2025.

It seems like everyone is trying to get on this bandwagon, especially now that the new Trump administration has finally brought regulatory clarity to the industry.

So… how justified is this move?

Stablecoin Growth in Numbers

To understand how promising stablecoin issuance is, let’s take a look at the numbers.

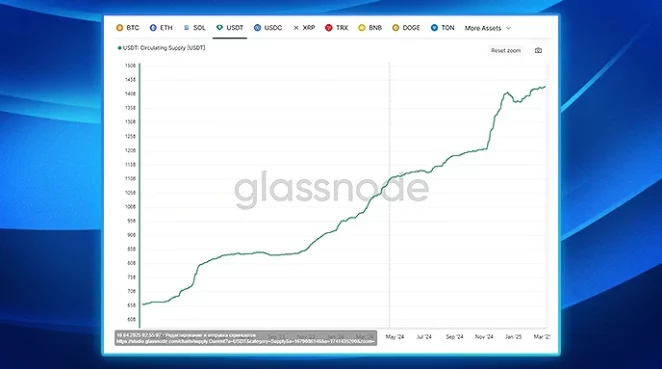

The number of USDT tokens in circulation has doubled over the past two years. While the second-largest stablecoin, USDC, saw its supply halved in 2023 compared to the previous year, it has since rebounded and surpassed previous levels.

Not only has capitalization increased, but the usage of key stablecoins like USDT and USDC has also expanded.

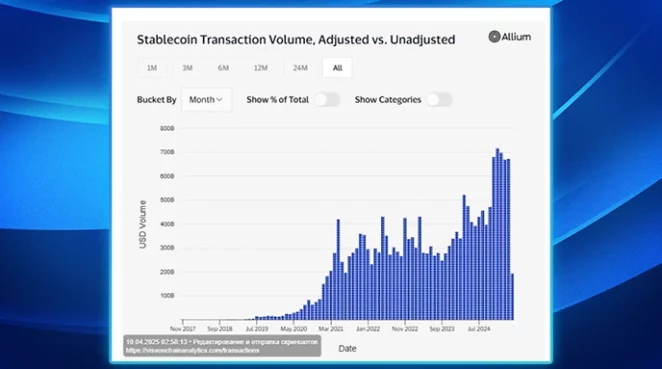

Visa Onchain Analytics reports that the total volume of funds transferred via stablecoins nearly doubled over the past year.

Additionally, VanEck predicts that daily settlement volumes using stablecoins will reach $300 billion USD by the end of 2025.

These trends indicate a growing demand for stablecoins as reliable tools for value transfer. As demand grows, so does the supply — so it’s no wonder that so many companies are rushing to issue their own assets.

Why are Stablecoins on the Rise?

There are several reasons behind this explosive growth. The advantages of stablecoins place them well above traditional fiat currencies in many respects.

These can be broken into three categories, the benefits for stablecoin issuers, the benefits for businesses, and the benefits for everyday spenders like you and me.

Benefits of Issuers

Stablecoin issuers are fundamentally driven by self-interest. This is especially true for fiat-backed stablecoins, where each digital dollar issued is matched by a real fiat dollar held in reserve.

With large fiat reserves, issuers can put that capital to work in various ways. For instance, Tether has earned an additional $7 billion USD in 2024 by holding $113 billion in US Treasury assets.

This “golden pot” tends to grow over time. As stablecoin adoption increases, so does the yield that issuers can earn from their reserves.

Additionally, established and regulatory-compliant issuers gain competitive advantages, especially in regions with clear stablecoin regulations, such as MiCA in the EU. These clear rules make it easier to establish partnerships with large enterprises, further solidifying their market position.

Benefits for Businesses

Companies that integrate stablecoins into their operations also benefit, often receiving a share of the profits.

For example, according to its S-1 filing to the SEC in April 2025, Coinbase received half of Circle’s residual revenue from the reserves backing the USDC stablecoin. In rough figures, this amounts to approximately $1.7 billion in revenue.

Also, stablecoins provide an upgraded payment infrastructure. With fewer intermediaries involved, businesses enjoy more control over chargebacks, along with enhanced transparency and security.

Other advantages include reduced transaction fees and faster settlement times. According to a16zcrypto (a subsidiary of a16z), traditional centralized payment solutions typically charge between $0.20 to $50 per transaction, with settlements taking up to 5 business days. In contrast, stablecoin transfers cost less than $0.01 and settle within minutes.

Benefits for End-Users

And what about regular users? Well, they win from stablecoins’ implementation as well.

Firstly, stablecoins offer attractive returns via staking.

On average, users can expect to earn 2–8% annually, depending on the platform and strategy used. Some pools even offer returns of 20% or more, depending on market conditions.

Compared to the 0.05% interest paid on savings accounts by major banks like Chase and Wells Fargo, this is a far more effective way to grow your wealth.

Fast, transparent transactions and lower fees are also highly appealing to everyday users. Combined with instant checkouts, stablecoins provide a significantly improved user experience.

The Era of Stablecoins Has Just Begun

All signs point to one conclusion: stablecoins are only just entering a new and transformative phase.

Given the benefits they offer to all market participants and their growing adoption, stablecoins have the potential to become foundational to the emerging digital economy.

Could they replace fiat?

Not likely, or at least… not entirely.

Most major stablecoins like USDT and USDC are fiat-pegged and still rely heavily on traditional money systems. However, they are well-positioned to claim a significant share of digital financial infrastructure.

Will the influx of new issuers dilute the dominance of current leaders and decentralize the market? That will depend heavily on the underlying technologies and regulatory frameworks.

One thing is certain: the infrastructure supporting stablecoins is only going to mature and expand from here.

Join The Leading Crypto Channel

JOINDisclaimer:Please note that nothing on this website constitutes financial advice. Whilst every effort has been made to ensure that the information provided on this website is accurate, individuals must not rely on this information to make a financial or investment decision. Before making any decision, we strongly recommend you consult a qualified professional who should take into account your specific investment objectives, financial situation and individual needs.

Kate

Kate is a blockchain specialist, enthusiast, and adopter, who loves writing about complex technologies and explaining them in simple words. Kate features regularly for Liquid Loans, plus Cointelegraph, Nomics, Cryptopay, ByBit and more.

Development

Knowledge

Subscribe To Newsletter

Stay up-to-date with all the latest news about

Liquid Loans, Fetch Oracle and more.

Copyright © 2024 Crave Management.

All Rights Reserved.

The LL Librarian

Your Genius Liquid Loans Knowledge Assistant